Introduction

As I’ve exited school and begun in the working world, I have developed an interest in personal finance. In particular, I’ve been interested in the best way to pay off debts (student loan, credit cards, auto loans) in order to put yourself on a path to building wealth for retirement, etc.

In my pursuit of knowledge, I’ve came across a variety of strategies. One of the biggest Personal Finance personalities that I discovered through podcasts is Dave Ramsey. Dave Ramsey provides a series of steps that he promises will help you to get out of debt and become wealthy and generous. “Live like no one else, so you can live and give like no one else”. He stresses becoming debt free through hard work (picking up extra hours or additional jobs) and trimming down your expenses during this process (beans and rice!). After paying your debt down with “Gazelle” intensity, your payment-free budget can be used to quickly build up a larger emergency fund, save for a home purchase, invest towards retirement, and pay additional mortgage principle.

However, the Dave Ramsey method is not without controversy. Because debts are to be paid down with gazelle intensity, other savings goals are to be ignored until “Baby Step 2 – pay off all debts” is complete. Some people disagree with this, and don’t see an advantage to paying off low interest rate debts when the money could achieve mathematically more through retirement investing/etc. One of the more inflammatory things he suggests is not going for the company matching retirement contributions. Many people outside of the Ramsey circle see these matching contributions as free money (guaranteed 50-100% return!) and additional income that you’re passing up (www.reddit.com/r/personalfinance is another good resource). Ultimately, after listening to dozens of hours of Dave’s podcast, it’s clear that he doesn’t expect a “gazelle” intense baby step 2, i.e., a barebones sacrificial budget with extra work if possible, to take more than 2-3 years. If it does take longer than that, either you’ve got a ridiculously large amount of debt, a very low income, or you are not living on beans and rice (and your budget could be cut further).

The goal of this blog post is to quantify the Dave Ramsey method, in particular with respect to leaving out the 401K match. I will compare long term wealth building potential when following Dave’s steps versus other recommendations. Ultimately, it will come down to how deep you are willing to cut to give up the 401K contributions, and whether the psychological win of paying off debt exceeds that of saving for retirement.

401K Matching vs. Paying Down Debt

Introducing The Software

First, I built a financial calculator that was probably overkill for solving this particular problem. I built in lots of little extras for computing your net worth and wealth distribution over time along with plotting features, etc. This code is available for free use/editing/contributing on the DaveRamseyFinCalc page on GitHub. I’d like to build a web-interface (Plot.ly?) at some point, but for now I’d like to get this post up. Future posts may follow with additional considerations with respect to the Dave Ramsey budget (one in particular is whether paying off your house early makes sense).

Stating The Assumptions

While it is possible to enter in a variety of values for your income, starting debt, assets, etc, I’m going to take a simple base case where you fit the following:

- $50k salary

- $63k in debt ($14k auto, $2k credit card, $49k student loans)

- 5% 401K Matching (100% vested immediately)

- 25% tax bracket

- 25% of (after tax) income paid to rent = $781/month while paying off debt

- Once debt paid, purchase a $200k house w/ 20% down

- Contribute 15% of pre-tax income to retirement once debts paid off

- Inflation rate of 1.5%

- 7% investment return

- 10% capital gains tax

I’ve made further assumptions about how much you spend on food and utilities ($650 + $200 = $850/month); Including rent, this totals $1631 (on month zero, before inflation has kicked in). Further, a $1000 emergency fund is used in both cases until debt is paid off, after which 4 months of expenses are used. Other assumptions and additional calculation details can be viewed in the DaveRamseyFinCalc GitHub code.

Results

Dave Ramsey vs. 401K Match

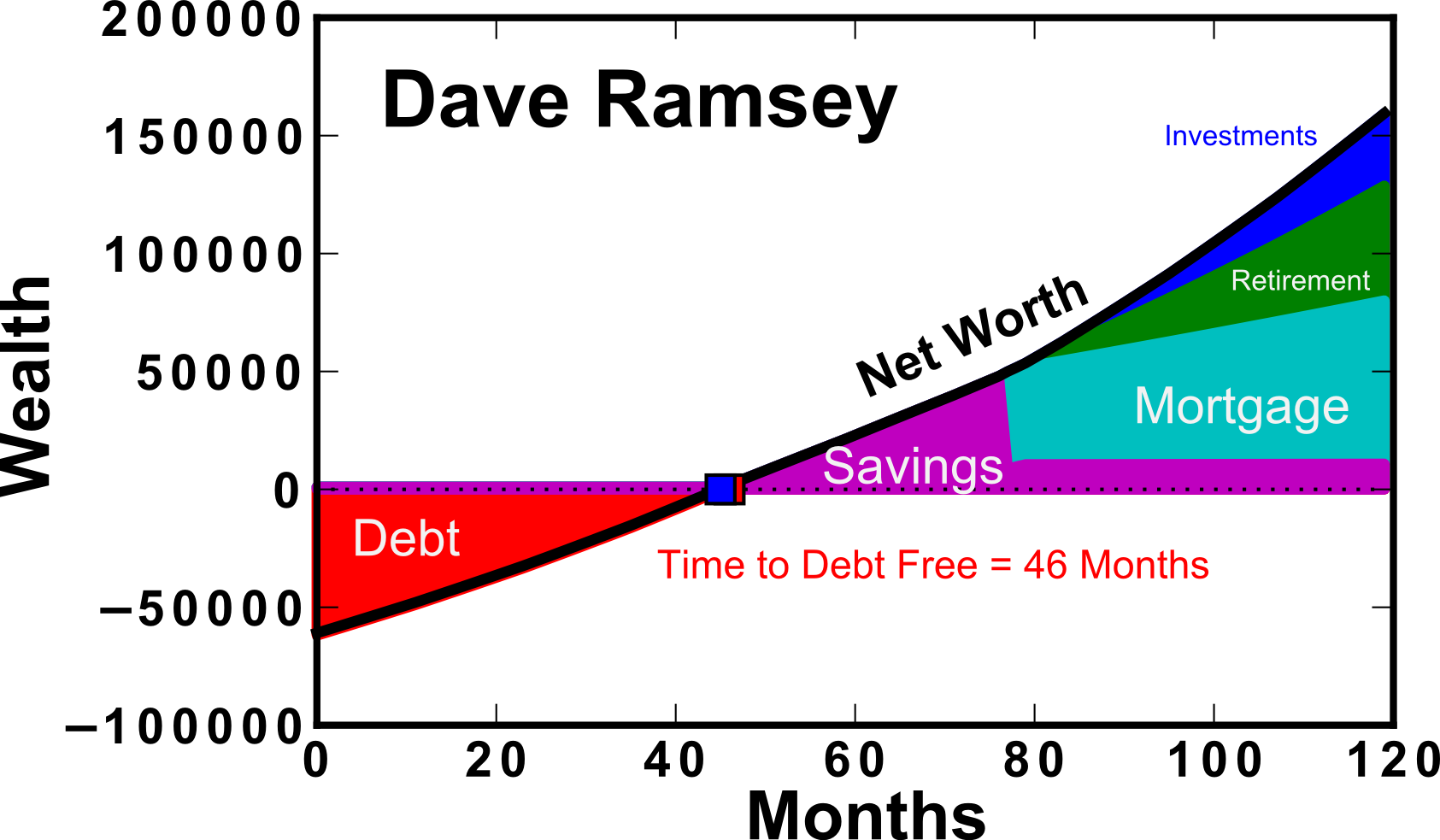

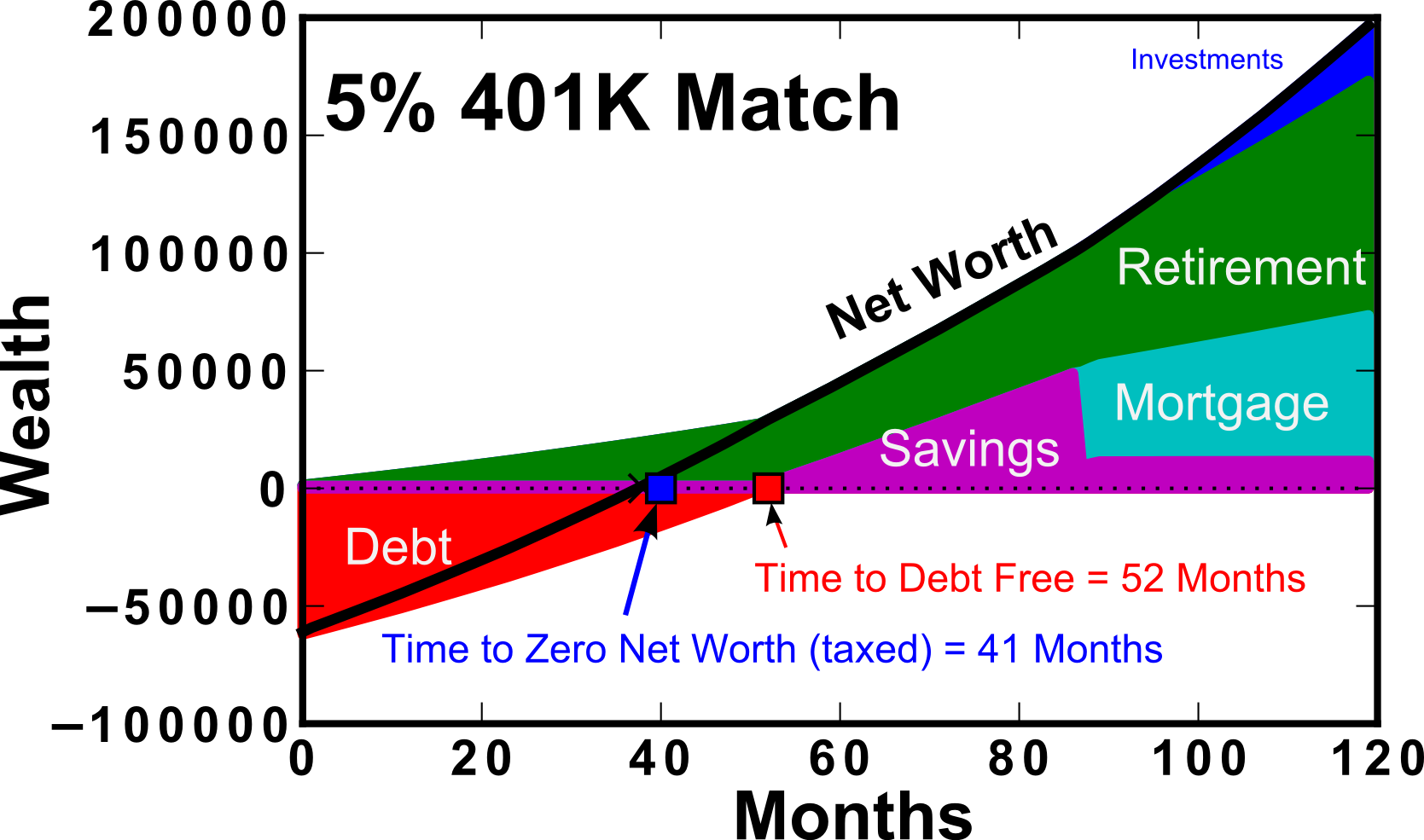

First, I’d like to show the overall calculation results with expected net worth accumulated over time. Figure 1 shows the results of a 10 year calculation using the Dave Ramsey method (left) and the 401K Match preference (right).

Figure 1: Top) Wealth over a 10 year period using the “Dave Ramsey” method of preferring debt payoff. Bottom) 5% 401K Match, where retirement savings is preferred over debt payoff in the initial years. Wealth is given in $, Net worth computed is pre tax.

In this calculation, 401K contributions are assumed to be made “before tax”. For this reason, the “taxed” wealth should be used as a comparison between the two methods (dashed line) as shown in Figure 2. It is clear that when comparing the after-tax (dashed lines), the results are closer together. This is because retirement contributions are assumed to go in before-tax, which inflates the “net worth” calculation (solid line). When considering the Dave Ramsey calculation, you can see that there is no difference between the before and after tax net worth until ~80 months. This is because of Baby Step 3b, which states that you should save for a house down-payment prior to contributing towards retirement as well. This extends the length of time that you’re not receiving the match even past the time to debt-free.

Figure 2: Net worth over a 10 year period assuming the 5% 401K match or the “Dave Ramsey” method of paying off debt first. The dashed lines in their corresponding colors represent the “after tax” amounts.Wealth is given in $.

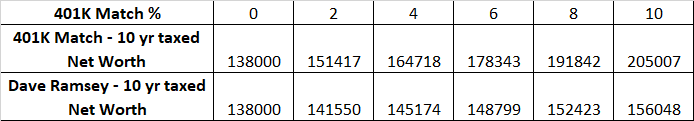

Effect of Varying 401K Match Amount

An additional calculation were performed varying the amount of the 401K match contribution offered by your employer. We can see that as the 401K match approaches zero, the 10 year net worth approaches $138k. The Dave Ramsey method does increase slightly with employer matching amount, however the rate is not as quick as when you’ve prioritized the 401K match. This is primarily due to the fact that it takes more than 3 years to pay off the debt, and missing out on this initial loading of your 401K causes a diversion of the 10 year net worth by as much as ~$50k for 401K Match of 10%. Table I also details the result as a function of match amount.

Figure 3: Net worth over a 10 year period assuming the 5% 401K match or the “Dave Ramsey” method of paying off debt first as a function of the offered 401K Match from your employer. Wealth is given in $.

Table I: 10 year taxed net worth as a function of 401K match amount (%).

The Caveat

So the previous plots show the real value of the 401K match, and how they can put you in a pretty good position relative to if you had prioritized debt payoff via the Dave Ramsey method. As an avid listener of Dave Ramsey’s, this isn’t something that he tries to hide. He receives the question often, and I’ll try to explain his justification. He sells the “gazelle intensity” where you cut your expenses back so much to attack the debt. As a result, the amount of ground lost on retirement would not be as large. Until now, this isn’t something that I considered, because both methods used the same monthly expenses. Further, this gazelle intensity combined with the “Snowball” Method of paying off your smallest debts first leads to the psychological wins necessary to keep lots of people going in this rough, beans and rice time.

I aimed to quantify Dave’s definition of “Gazelle intensity” by determining how much one would have to cut back their budget in order to attain a net zero taxed net worth in the same month as if you had been contributing to the match on your 401K.

Figure 4: Expense reduction required to attain zero taxed net worth at the same month using the Dave Ramsey method (cyan) as the 401K match method (black).

An additional consideration is how long you’re living on the edge with a bare-bones emergency fund ($1000). In this simple calculator, I’ve taken as a given that until the debt is gone, the emergency fund will stay that size. This may or may not be a reasonable thing to assume, but it’s what Dave Ramsey teaches. Either way, you end up having less time living on the brink if you’re paying off your debt faster.

Figure 5: Number of months that it takes to become debt free using the 401K Match method and the Dave Ramsey method (open black and solid cyan symbols, respectively). Also, the time that you reach zero taxed net worth using the 401K method (solid black symbols)

Conclusions

At the end of the day, I love Dave’s podcast. It’s entertaining and inspirational to listen to people who strive to become debt free. His baby steps do make a lot of sense, and I don’t think that there’s anything wrong with encouraging frugality and hard work. Dave aims to target the widest possible audience, which includes those who haven’t really ever thought about personal finance, and may not even have a reasonable budget estimate. At the end of the day, if you spend more than you make and you’re not intentional with your $$ it will be difficult to get ahead. Regarding the 401K Match, it’s something that’s definitely going to put you ahead in the long run and as long as you understand it (and are intentional with it!), it’s extra income and will be helpful.

I’m a huge Dave Ramsey fan myself. I think you did a great job analyzing his steps. The graphs showing the different steps were particularly helpful for visualizing them.

For my part, I did temporarily stop my 401k contributions to avoid debt. But it was only for 8 months. For much longer than a year it would not make sense to stop.

Great article.